The Importance of Equipment Breakdown Insurance for Manufacturers

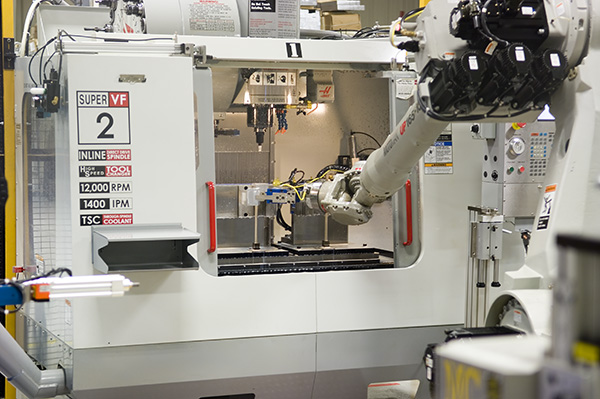

There is nothing more important to a manufacturer than their machinery. Subsequently, when a breakdown occurs, the impact can be devastating. When equipment grinds to a halt, deliveries are delayed, and/or job orders are lost, revenue stops and the cost of continuing operations rises. Equipment Breakdown insurance is designed to help keep a shop operating and also protect the insured from mechanical and or electrical breakdowns. It should also protect the business owner from mechanical or electrical equipment damage caused by operator error, poor workmanship, or negligence.

Equipment Breakdown policies cover the cost to repair or replace key pieces of equipment. Equipment in a policy is defined as follows:

- equipment built to operate under internal pressure, such as boilers and pressure vessels

- electrical or mechanical equipment used in the generation, transmission or utilization of energy

- communication and computer equipment

- the equipment used by a utility to supply its services

In addition to paying to repair or replace the equipment, a policy may pay for other expenses related to the loss. These can include lost income, extra expenses needed to continue operations while the machinery is being repaired, or the lost value of spoiled or contaminated products.

There are several key reasons that make Equipment Breakdown insurance so critical to an operation, including:

- Mechanical and Electrical Breakdown insurance covers specific equipment damaged by mechanical and electrical failure and other events, which are typically excluded from Commercial Property policies. For example, damage to equipment from short circuits/electrical arcing, power surges, mechanical breakdown and explosion of pressure vessels is not covered under a Commercial Property policy. Equipment Breakdown insurance steps in to fill in these gaps.

- Operator Error and Negligence is included in the Equipment Breakdown coverage. Operator error resulting in equipment damage is the most common cause of loss for any manufacturer. This can come to a surprise to most but these situations would and should be covered.

Most equipment contains a range of sophisticated controls and sensors, Internet connectivity, and advanced electronic sub-components. Components include transformers, panels and cables, and because these are interconnected, excessive voltage in one component can lead to significant damage to others. Arcing, for instance, can cause damage to a panel, as well as completely close down an operation. Fragile technologies today also make computer-generated machinery susceptible to electronic damage due to electrical surges, sags, etc. The cost to replace these machines can be significant. Even though the equipment may not cost a great deal to repair, the cost of missed shipments and loss in production adds up quickly.

OAK Insurance Solutions specializes in insuring manufacturers, including but not limited to the following: steel fabricators, machine shops, food and beverage manufacturing and plastic manufacturing. We partner with leading carriers that can provide comprehensive Equipment Breakdown coverage for our clients. For a consultation, please call OAK Insurance Solutions at (626) 818-8987 to speak with a member of our team.