As we age, get married, have children, become our parents’ caretakers, and transition through the chapters of life, life insurance increases in importance. In fact, depending on the type of policy, here in Glendora (and surrounding areas), life insurance is fairly cheap, particularly the earlier you get it. Therefore, there is no excuse why one, with dependents and a family, doesn’t have coverage. It should be a fundamental part of your financial plan and a necessary element to protecting your dependents and loved ones in the event of your passing.

As we age, get married, have children, become our parents’ caretakers, and transition through the chapters of life, life insurance increases in importance. In fact, depending on the type of policy, here in Glendora (and surrounding areas), life insurance is fairly cheap, particularly the earlier you get it. Therefore, there is no excuse why one, with dependents and a family, doesn’t have coverage. It should be a fundamental part of your financial plan and a necessary element to protecting your dependents and loved ones in the event of your passing.

As a Glendora life insurance agent I’ve met many families grateful for having coverage after their loved ones have passed, and conversely, many who wish they had obtained coverage sooner. To shed some light on the importance of life insurance, here are 5 reasons you should obtain coverage from your…

Glendora Life Insurance Agent:

1) Do you have or plan on having dependents?

If you have someone financially relying on your income, such as a child, parent, or spouse, then life insurance is a must as it replaces your income when you die. In particular, if you’re a parent of young children or the main provider in your household, then coverage is essential. Side note, to find out how much life insurance you’ll need to replace your income and how affordable it is to protect and continue to provide for your dependents even after you die, contact us at 626.818.8987.

2) Do you wish to leave an inheritance?

Although many wish to leave an inheritance for their loved ones, they can’t if they don’t have the assets to pass to their heirs. So what can they do? They can obtain life insurance and name their heirs as their beneficiaries. This essentially provides an inheritance and sets up their loved ones for financial success.

3) Do you want to help your family cover outstanding debts after your passing?

Losing a loved one is difficult and can leave an emotional burden on your family as they attempt to ease their loss. Therefore, the last thing they need during such trying times is added financial burden. Outstanding debts, such as credit cards, car loans, and/or mortgages, as well as funeral and burial expenses costing upwards of tens of thousands of dollars, can place your family in financial hardship, in particular if they’re one income short. Prevent the risk; protect your family with life insurance.

Think about it…

Do you or your spouse have any student loans?

Sunny California is a wonderful state to live in. However, it comes with a downfall. We live in a community state. Therefore, if your spouse dies, you may be liable for their debts and vice versa. So if either of you have any private student loans and one dies, regardless whether you are a co-signer or not, the other will be responsible for that debt.

Do you or your spouse have housing expenses (i.e. rent or a mortgage)?

When you and your spouse share a home, either one or the both of you, are responsible to pay the mortgage or rent. Accordingly, you must ask yourself whether each of you can afford the housing expense on your individual incomes. If you can’t, then life insurance is a must.

4) Do you want to maintain a particular lifestyle?

Eliminating an income source due to death can immediately halt a lifestyle you’re both accustomed to. Therefore, reduce the fear of the unknown and the question of how your family will financially survive with one less income by obtaining life insurance to cover their everyday living expenses.

5) Do you want to add more financial security?

Like most parents, you probably want to know your kids will be well taken care of when you’re gone. You not only want to cover for their everyday expenses (i.e. food, clothing, shelter), but you want to provide them with a quality college education, and perhaps help them one day get married, start a business, and/or buy their first home. For this reason, coverage is essential while your kids are still at home.

While we don’t know when we’ll pass, we do know we can continue to provide for and protect our loved ones afterwards. Don’t fall into the statistics. According to one study, “91% of widows lose everything in the first twelve months after their husband’s death…Houses, cars, education for kids, their entire lifestyle is forced to change.” Make sure your family is not part of the statistics. Gain peace of mind by getting life insurance coverage, and continuing to help take care of your loved ones when you’re gone.

To learn more about life insurance coverage and other programs, please contact OAK Insurance Solutions.

CALL) 626.775.7850

TEXT) 626.818.8987

EMAIL ME HERE

Damon Volz-Fleischer, is an entrepreneur and small business owner ranking amongst the top licensed contractors in Southern California. His business, DT Stainless, specializes in commercial stainless steel services and repair. His wife, Tracy, is a hardworking mother of two and an emergency dispatcher for the local police department. We thank Tracy for her public service, as dispatchers are an integral part of the organization’s success. We appreciate both their work and dedication to the community.

Damon Volz-Fleischer, is an entrepreneur and small business owner ranking amongst the top licensed contractors in Southern California. His business, DT Stainless, specializes in commercial stainless steel services and repair. His wife, Tracy, is a hardworking mother of two and an emergency dispatcher for the local police department. We thank Tracy for her public service, as dispatchers are an integral part of the organization’s success. We appreciate both their work and dedication to the community.  The products, services, and benefits provided include:

The products, services, and benefits provided include:

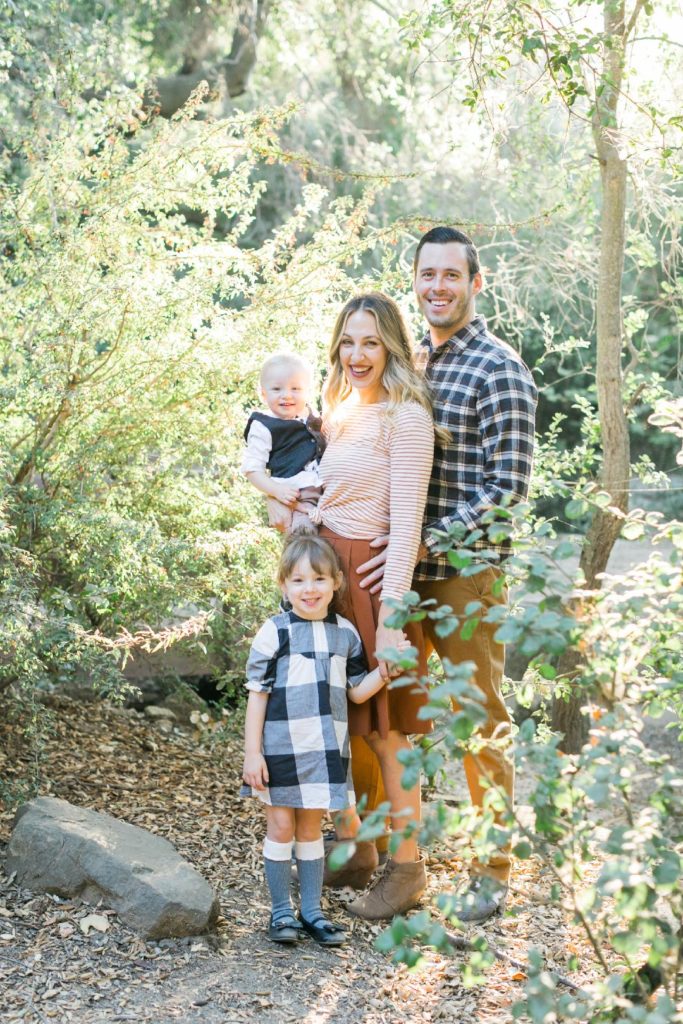

Meet Trevor Gould. Business Development and Sales professional, Trevor is responsible for all new commercial paving and sealing projects. As many of us know, new business sales is hard work! Therefore, we can appreciate his resilience and successes. Similarly, his wife, Candice, not only is a store manager for Lululemon, but she is a new mother to their beautiful little girl, Chandler. Being a Mom is a job in itself and we commend you and all working Moms.

Meet Trevor Gould. Business Development and Sales professional, Trevor is responsible for all new commercial paving and sealing projects. As many of us know, new business sales is hard work! Therefore, we can appreciate his resilience and successes. Similarly, his wife, Candice, not only is a store manager for Lululemon, but she is a new mother to their beautiful little girl, Chandler. Being a Mom is a job in itself and we commend you and all working Moms. Our success with the Gould Family began with a gap analysis on their current and recommended limits of insurance. Through this we recognized areas where increase in coverage was necessary, strategies to consolidate carriers, and put together an updated portfolio with significant savings. The products, services, and benefits to our review include the following:

Our success with the Gould Family began with a gap analysis on their current and recommended limits of insurance. Through this we recognized areas where increase in coverage was necessary, strategies to consolidate carriers, and put together an updated portfolio with significant savings. The products, services, and benefits to our review include the following: Since 1963, Arcadia Montessori School has been providing a warm, nurturing, safe, and guiding environment for children to reach their fullest potential. For that reason, we are proud to introduce them as our newest client and share our story about helping them reduce risk and save on property, casualty, workers compensation, and excess liability insurance.

Since 1963, Arcadia Montessori School has been providing a warm, nurturing, safe, and guiding environment for children to reach their fullest potential. For that reason, we are proud to introduce them as our newest client and share our story about helping them reduce risk and save on property, casualty, workers compensation, and excess liability insurance. With 54 years of educational experience, Arcadia Montessori School is the oldest and most prestigious Montessori Preschool in the San Gabriel Valley, helping over 5,000 children flourish. Providing programs for children ages 2 through 6 year old in Arcadia, California (and surrounding), each child is encouraged to learn and explore their interests through a prepared environment.

With 54 years of educational experience, Arcadia Montessori School is the oldest and most prestigious Montessori Preschool in the San Gabriel Valley, helping over 5,000 children flourish. Providing programs for children ages 2 through 6 year old in Arcadia, California (and surrounding), each child is encouraged to learn and explore their interests through a prepared environment.

“As a small business owner with limited resources, I rely heavily on Michael’s product knowledge and business insurance counsel. Michael and his staff handle all of my business insurance requirements: Property, Casualty, Excess Liability and Workers Compensation. The highest level of customer service mixed with their rare ability to connect with clients on a personal level make it easy to recommend OAK Insurance Solutions to ALL family, friends, coworkers and other business owners.”

“As a small business owner with limited resources, I rely heavily on Michael’s product knowledge and business insurance counsel. Michael and his staff handle all of my business insurance requirements: Property, Casualty, Excess Liability and Workers Compensation. The highest level of customer service mixed with their rare ability to connect with clients on a personal level make it easy to recommend OAK Insurance Solutions to ALL family, friends, coworkers and other business owners.”

It can be both exciting and stressful for newlyweds to merge their lives together. Once married, you tend to move in together, share finances, share debts, change last names, and transition from single life to a partnership. However, one of the most important actions newlyweds must take is updating their insurance policies. Besides health, once you’re married, you should review your auto, homeowners, and life insurance policies to ensure it’s taking into consideration your new marriage and providing adequate coverage. For instance…

It can be both exciting and stressful for newlyweds to merge their lives together. Once married, you tend to move in together, share finances, share debts, change last names, and transition from single life to a partnership. However, one of the most important actions newlyweds must take is updating their insurance policies. Besides health, once you’re married, you should review your auto, homeowners, and life insurance policies to ensure it’s taking into consideration your new marriage and providing adequate coverage. For instance…

Meet Alex, owner and partner of The Napolin Law Firm. Alex has quickly positioned himself as the leading personal injury attorney in all of Southern California.

Meet Alex, owner and partner of The Napolin Law Firm. Alex has quickly positioned himself as the leading personal injury attorney in all of Southern California. Meet his wife, Jenna, who dedicated three years to the Downtown Women’s Center addressing poverty and homelessness in Skid Row; after which she took on a more selfless role as mother to their two beautiful children.

Meet his wife, Jenna, who dedicated three years to the Downtown Women’s Center addressing poverty and homelessness in Skid Row; after which she took on a more selfless role as mother to their two beautiful children.

Thank you to The Napolin Family for their trust and business. We value them as clients and great people!

Thank you to The Napolin Family for their trust and business. We value them as clients and great people! As we age, get married, have children, become our parents’ caretakers, and transition through the chapters of life, life insurance increases in importance. In fact, depending on the type of policy, here in Glendora (and surrounding areas), life insurance is fairly cheap, particularly the earlier you get it. Therefore, there is no excuse why one, with dependents and a family, doesn’t have coverage. It should be a fundamental part of your financial plan and a necessary element to protecting your dependents and loved ones in the event of your passing.

As we age, get married, have children, become our parents’ caretakers, and transition through the chapters of life, life insurance increases in importance. In fact, depending on the type of policy, here in Glendora (and surrounding areas), life insurance is fairly cheap, particularly the earlier you get it. Therefore, there is no excuse why one, with dependents and a family, doesn’t have coverage. It should be a fundamental part of your financial plan and a necessary element to protecting your dependents and loved ones in the event of your passing.

Recent Comments