Glendora Homeowners Insurance – Theft, vandalism, fire, smoke, sudden cracking, etc…you never know when problems will strike, but when they do, homeowners insurance can protect you and safeguard your investment.

This is one reason the majority of lenders require homeowners insurance. However, regardless to whether you have a mortgage or not on your property, protection is strongly recommended.

This is one reason the majority of lenders require homeowners insurance. However, regardless to whether you have a mortgage or not on your property, protection is strongly recommended.

Glendora Homeowners Insurance – What Is & Isn’t Covered

Generally speaking, there are a variety of Glendora homeowners insurance policies, but the two most common types of are HO-2 and HO-3. A breakdown of the policies are stated below:

HO-1 – Basic Homeowners Insurance Policy

Under a HO-1 policy, generally 11 perils are covered. These include the structure of the home, the property within it, and the structures on the land damaged by:

- Fire or Lightening

- Smoke

- Theft

- Vandalism

- Damage from vehicles

- Damage from aircraft

- Windstorms and hail

- Riots and civil commotion

- Volcanic eruptions

- Explosions

- Glass Damage

HO-2 – Broad Perils

Under an HO-2 Glendora Homeowners Insurance policy, the above items are covered, plus:

- Fallings objects

- Weight of ice, snow or sleet

- Accidental discharge or overflow of water or stream from within plumbing or related systems (does not include discharge or overflow of water from a sump)

- Sudden and accidental rupture of a heating, air conditioning, fire protective sprinkler, or hot water heating system

- Freezing of plumbing or related systems

- Sudden and accidental damage from artificially generated electrical current

HO-3 – Special Form

Broader than a HO-2 policy, a HO-3 covers all the perils under a HO-2 policy and all risks not excluded by the insurer. Typically, a Glendora homeowners insurance HO-3 policy insures your home and attached structures (i.e. a garage or deck), as well as your belongings and personal liability if you accidentally injure someone or damage their property.

In addition to the above, other homeowners insurance policies include:

HO-4 – Tenant’s Farm

HO-4 coverage is specifically for renters, covering belongings and personal liability as opposed to the building itself (as that’s usually covered by the landlord’s policy).

HO-5 – Comprehensive Form

Coverage, here, is broader than a HO-3 policy.

HO-6 – Condo Form

HO-6 coverage is generally the same as a typical homeowners insurance, but it specifically is for condo owners and generally protects belongings, personal liability, walls, floors, and the ceiling. The remaining portions of the condo structure is usually covered by a policy covered by the owner’s homeowners association.

HO-7 – Mobile Home Form

A HO-7 Glendora homeowners insurance policy is generally the same as a typical homeowners insurance, but it specifically is for mobile or manufactured homes.

HO-8 – Older Home Form

HO-8 coverage is designed to address specific concerns that arise with older homes, usually seen with older and historic homes.

That said, there are problems that are typically not covered under traditional homeowners insurance. These include:

- Flooding

- Earthquakes

- Landslides

- Mold

- Infestations

- Wear and tear

- Nuclear hazard

- Government action

However, you can purchase separate policies to cover the above and provide added benefit.

Taking these factors into consideration, a natural question one may ask, is…how much coverage does one need? To answer this, allow me to explain the basic parts of a Glendora homeowners insurance policy. Standard coverage includes:

Taking these factors into consideration, a natural question one may ask, is…how much coverage does one need? To answer this, allow me to explain the basic parts of a Glendora homeowners insurance policy. Standard coverage includes:

- Dwelling Protection: Covers damage to the home and attached structures.

- Stand-Alone Structure Protection: These cover such structures as a fence, carport, or toolshed.

- Loss of Use: This provides additional living expense coverage, such as helping pay for temporary relocation and basic living expenses if you are forced to vacate your home.

- Personal Property Coverage: This covers one’s belongings (i.e. furniture and dishes), helping pay to repair or replace stolen or damaged belongings.

- Liability Coverage: This coverage protects you financially if you are responsible for another’s injuries arising on your property.

- Medical Payments Coverage: This covers injury treatment costs for those injured on the property.

When it comes to home coverage, many fall under the misconception that they must purchase coverage equivalent to the purchase price or market value of their home. However, that’s not the case. Instead, you should obtain coverage equivalent to your home’s rebuilding cost. This is based on what it would cost local construction to rebuild your home/property if damaged. A Glendora homeowners insurance agent, such as OAK Insurance Solutions, can give provide you with an accurate quote on your home’s replacement cost. However, you can estimate the cost by multiplying your property’s square footage with local construction costs per square foot. The problem for many is that they simply obtain coverage equivalent to their home’s real estate market value. But, this risks under coverage and not having enough funds to repair your home if disaster strikes.

In terms of personal property coverage, you generally want coverage for at least 50% of your dwelling coverage amount. That said, you can decrease or increase your limit if you wish. Hence, it is usually suggested to take inventory of your home and speak with your agent for the best recommended coverage. An insurance agent can also help you determine whether to obtain coverage equivalent to your property’s replacement coverage (which does not factor in depreciation) and the actual cash value (which usually is cheaper but bases claims payments on your belongings’ depreciated value).

Cost of homeowners insurance

Again, to determine the cost of your homeowners insurance, you should speak with your insurance agent. Typically though, the following are considered:

- The cost to rebuild your home

- Your coverage limits and deductibles

- Your home’s age

- Your claims history as well as the history of claims in your neighborhood

- Where you live

If working with an experienced and cost-saving focused agent, as Glendora Homeowners Insurance – OAK Insurance Solutions, there are factors to take into consideration to reduce your costs. These can include:

- Obtaining coverage based on your home’s rebuilding cost and not your purchase price. A home’s purchase price includes the land under your house, which isn’t at risk. Therefore, if it’s based on the higher valued purchase price, it can mean you have to pay higher premiums.

- Some companies that sell homeowners, auto, and liability coverages will take 5 to 10% off your premium if you buy two or more policies from them. And as you may have seen on OAK Insurance Solutions’ testimonials, clients are saving at least 15% by bundling their policies.

- Increase your home’s safety features. For instance, by having a stronger roof, modern heating/plumbing/electrical systems, smoke detectors, sophisticated sprinkler systems, smoke detectors, burglar alarms, dead bolt locks, or etc…you can see substantially more discounts.

- Although many fall into credit problems, by working to improve and maintain good credit, you can see additional discounts to your policy.

- Annually review your homeowners insurance policy and update your coverage. For instance, if you have floater or extra insurance covering a high-end computer which you no longer own, then you may want to cancel that coverage and reduce your rates.

- For added discounts contact OAK Insurance Solutions.

There you have it, the basics of homeowners insurance. To learn more about how you can save by increasing your coverage, contact OAK Insurance Solutions.

CALL) 626.775.7850

TEXT) 626.818.8987

EMAIL ME HERE

Unfortunately, you will soon be experiencing a substantial rate increase if your insurance is placed with Nationwide, Allstate, USAA, Liberty Mutual, or State Farm, expect an insurance rate increase.

Unfortunately, you will soon be experiencing a substantial rate increase if your insurance is placed with Nationwide, Allstate, USAA, Liberty Mutual, or State Farm, expect an insurance rate increase.

As spring approaches, homeowners often plan projects. Some want new floors. Others wish to update their kitchens or bathrooms. Similarly, some plan on doing the work themselves (with the help of Pinterest). Others plan on hiring contractors. If you are thinking about remodeling, whatever path you take, you must make sure you have adequate coverage. You should confirm your policy will cover your project, home, and content. Furthermore, you must make sure the remodeling doesn’t void your policy.

As spring approaches, homeowners often plan projects. Some want new floors. Others wish to update their kitchens or bathrooms. Similarly, some plan on doing the work themselves (with the help of Pinterest). Others plan on hiring contractors. If you are thinking about remodeling, whatever path you take, you must make sure you have adequate coverage. You should confirm your policy will cover your project, home, and content. Furthermore, you must make sure the remodeling doesn’t void your policy. This is one reason the majority of lenders require homeowners insurance. However, regardless to whether you have a mortgage or not on your property, protection is strongly recommended.

This is one reason the majority of lenders require homeowners insurance. However, regardless to whether you have a mortgage or not on your property, protection is strongly recommended. Taking these factors into consideration, a natural question one may ask, is…how much coverage does one need? To answer this, allow me to explain the basic parts of a Glendora homeowners insurance policy. Standard coverage includes:

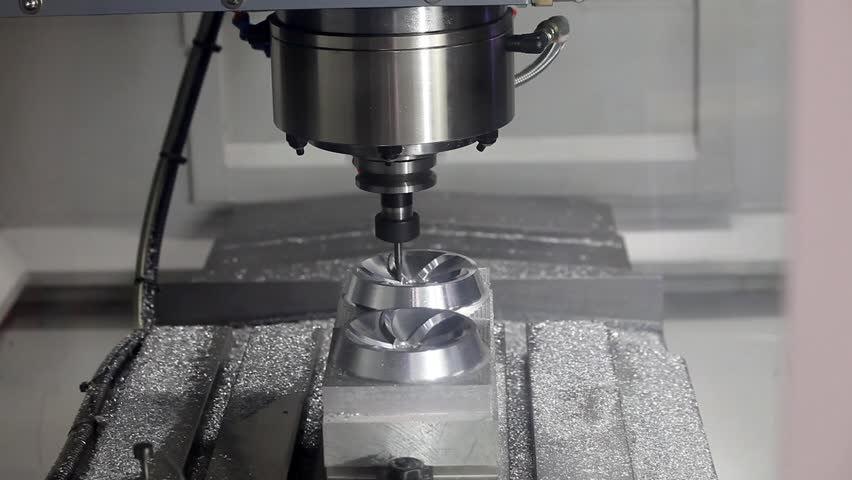

Taking these factors into consideration, a natural question one may ask, is…how much coverage does one need? To answer this, allow me to explain the basic parts of a Glendora homeowners insurance policy. Standard coverage includes: Glendora Insurance – OAK Insurance Solutions is well known as the manufacturing insurance experts. Our product knowledge stems from over 10 years of Aerospace and Defense Manufacturing experience. Understanding the manufacturing process, business, and requirements, allows us to offer the best priced and comprehensive manufacturing owner policies. Accordingly, bringing on Jaeckel Tool & Manufacturing onto OAK’s portfolio of clients was a perfect fit.

Glendora Insurance – OAK Insurance Solutions is well known as the manufacturing insurance experts. Our product knowledge stems from over 10 years of Aerospace and Defense Manufacturing experience. Understanding the manufacturing process, business, and requirements, allows us to offer the best priced and comprehensive manufacturing owner policies. Accordingly, bringing on Jaeckel Tool & Manufacturing onto OAK’s portfolio of clients was a perfect fit. Jaeckel Tool is well known as the experts in precision Jig, Fixture, Tool and Die Design and Manufacturing. Over 40 years of Tool and Diemaking experience from seasoned and highly skilled journeymen have helped them build a solid reputation in the manufacturing world. Founder and owner, John Jaeckel has created one of the most respected tool shops in all of Southern California and continues to be the preferred toolmaker for the Aerospace, Automotive, Medical and Commercial industries.

Jaeckel Tool is well known as the experts in precision Jig, Fixture, Tool and Die Design and Manufacturing. Over 40 years of Tool and Diemaking experience from seasoned and highly skilled journeymen have helped them build a solid reputation in the manufacturing world. Founder and owner, John Jaeckel has created one of the most respected tool shops in all of Southern California and continues to be the preferred toolmaker for the Aerospace, Automotive, Medical and Commercial industries. Jaeckel Tool and Manufacturing, Inc. specializes in jig grinding and boring to insure the most precise tools, dies and fixtures. Rapid manufacturing principles mixed with expert diemakers can quickly produce extremely durable tools that produce accurate, repeatable, and high quality components that add value to all manufacturing processes.

Jaeckel Tool and Manufacturing, Inc. specializes in jig grinding and boring to insure the most precise tools, dies and fixtures. Rapid manufacturing principles mixed with expert diemakers can quickly produce extremely durable tools that produce accurate, repeatable, and high quality components that add value to all manufacturing processes. The products, services and benefits to our review and in turn provide Jaeckel Tool & Manufacturing great value include:

The products, services and benefits to our review and in turn provide Jaeckel Tool & Manufacturing great value include:

Through this opportunity we were able to review their existing property and casualty package and offer them the following products, services, and benefits:

Through this opportunity we were able to review their existing property and casualty package and offer them the following products, services, and benefits: This family-style restaurant located in Covina offers a unique and simple menu that has redefined a food that transcends cultures. Dating back to Ancient Rome, the meatball recipe has remained virtually the same. That was until 2014 when The Brew and Meatball Company opened its doors.

This family-style restaurant located in Covina offers a unique and simple menu that has redefined a food that transcends cultures. Dating back to Ancient Rome, the meatball recipe has remained virtually the same. That was until 2014 when The Brew and Meatball Company opened its doors. Owners and Founders, Danielle and Carlos Duarte, take pride in their alternative for the delicious and flavorful comfort food. Meatballs are prepared with special ingredients and served featuring different ground meats: beef, pork, chicken and others. Their signature dishes include meatball samplers, meatball sliders, meatball tacos, meatball burgers, and traditional meatballs. All are served fresh and include their original homemade companion sauces. They truly are culinary artists with “mad flavor and wicked creativity.”

Owners and Founders, Danielle and Carlos Duarte, take pride in their alternative for the delicious and flavorful comfort food. Meatballs are prepared with special ingredients and served featuring different ground meats: beef, pork, chicken and others. Their signature dishes include meatball samplers, meatball sliders, meatball tacos, meatball burgers, and traditional meatballs. All are served fresh and include their original homemade companion sauces. They truly are culinary artists with “mad flavor and wicked creativity.” Delicious food and craft beer, mixed with the perfect ambiance, makes them easy to recommend!

Delicious food and craft beer, mixed with the perfect ambiance, makes them easy to recommend! Thank you to The Brew and Meatball Company for their trust and business. We value them as clients and as a great establishment!

Thank you to The Brew and Meatball Company for their trust and business. We value them as clients and as a great establishment! Location:

Location: Damon Volz-Fleischer, is an entrepreneur and small business owner ranking amongst the top licensed contractors in Southern California. His business, DT Stainless, specializes in commercial stainless steel services and repair. His wife, Tracy, is a hardworking mother of two and an emergency dispatcher for the local police department. We thank Tracy for her public service, as dispatchers are an integral part of the organization’s success. We appreciate both their work and dedication to the community.

Damon Volz-Fleischer, is an entrepreneur and small business owner ranking amongst the top licensed contractors in Southern California. His business, DT Stainless, specializes in commercial stainless steel services and repair. His wife, Tracy, is a hardworking mother of two and an emergency dispatcher for the local police department. We thank Tracy for her public service, as dispatchers are an integral part of the organization’s success. We appreciate both their work and dedication to the community.  The products, services, and benefits provided include:

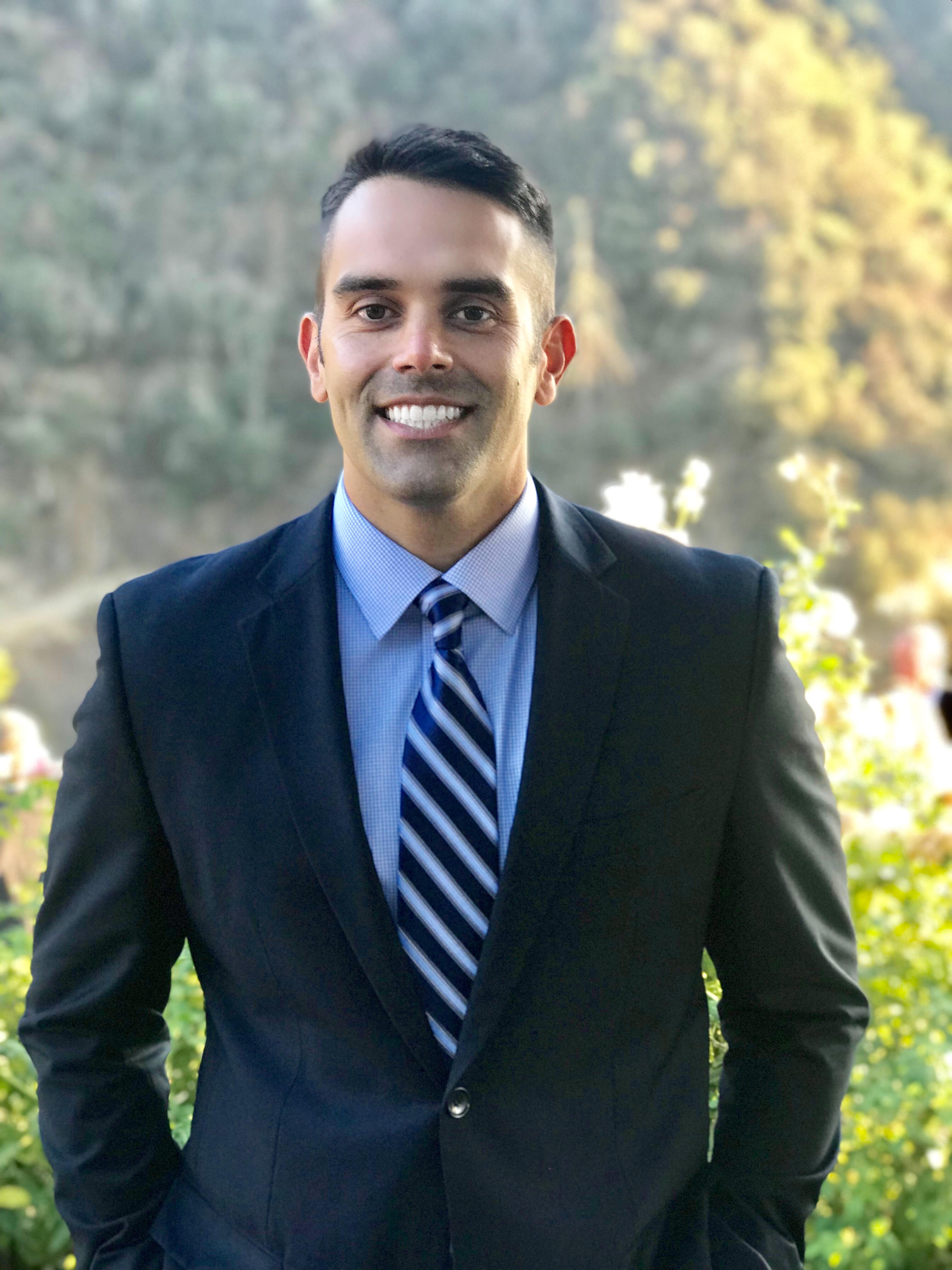

The products, services, and benefits provided include: Meet Trevor Gould. Business Development and Sales professional, Trevor is responsible for all new commercial paving and sealing projects. As many of us know, new business sales is hard work! Therefore, we can appreciate his resilience and successes. Similarly, his wife, Candice, not only is a store manager for Lululemon, but she is a new mother to their beautiful little girl, Chandler. Being a Mom is a job in itself and we commend you and all working Moms.

Meet Trevor Gould. Business Development and Sales professional, Trevor is responsible for all new commercial paving and sealing projects. As many of us know, new business sales is hard work! Therefore, we can appreciate his resilience and successes. Similarly, his wife, Candice, not only is a store manager for Lululemon, but she is a new mother to their beautiful little girl, Chandler. Being a Mom is a job in itself and we commend you and all working Moms. Our success with the Gould Family began with a gap analysis on their current and recommended limits of insurance. Through this we recognized areas where increase in coverage was necessary, strategies to consolidate carriers, and put together an updated portfolio with significant savings. The products, services, and benefits to our review include the following:

Our success with the Gould Family began with a gap analysis on their current and recommended limits of insurance. Through this we recognized areas where increase in coverage was necessary, strategies to consolidate carriers, and put together an updated portfolio with significant savings. The products, services, and benefits to our review include the following: Since 1963, Arcadia Montessori School has been providing a warm, nurturing, safe, and guiding environment for children to reach their fullest potential. For that reason, we are proud to introduce them as our newest client and share our story about helping them reduce risk and save on property, casualty, workers compensation, and excess liability insurance.

Since 1963, Arcadia Montessori School has been providing a warm, nurturing, safe, and guiding environment for children to reach their fullest potential. For that reason, we are proud to introduce them as our newest client and share our story about helping them reduce risk and save on property, casualty, workers compensation, and excess liability insurance. With 54 years of educational experience, Arcadia Montessori School is the oldest and most prestigious Montessori Preschool in the San Gabriel Valley, helping over 5,000 children flourish. Providing programs for children ages 2 through 6 year old in Arcadia, California (and surrounding), each child is encouraged to learn and explore their interests through a prepared environment.

With 54 years of educational experience, Arcadia Montessori School is the oldest and most prestigious Montessori Preschool in the San Gabriel Valley, helping over 5,000 children flourish. Providing programs for children ages 2 through 6 year old in Arcadia, California (and surrounding), each child is encouraged to learn and explore their interests through a prepared environment.

“As a small business owner with limited resources, I rely heavily on Michael’s product knowledge and business insurance counsel. Michael and his staff handle all of my business insurance requirements: Property, Casualty, Excess Liability and Workers Compensation. The highest level of customer service mixed with their rare ability to connect with clients on a personal level make it easy to recommend OAK Insurance Solutions to ALL family, friends, coworkers and other business owners.”

“As a small business owner with limited resources, I rely heavily on Michael’s product knowledge and business insurance counsel. Michael and his staff handle all of my business insurance requirements: Property, Casualty, Excess Liability and Workers Compensation. The highest level of customer service mixed with their rare ability to connect with clients on a personal level make it easy to recommend OAK Insurance Solutions to ALL family, friends, coworkers and other business owners.”

It can be both exciting and stressful for newlyweds to merge their lives together. Once married, you tend to move in together, share finances, share debts, change last names, and transition from single life to a partnership. However, one of the most important actions newlyweds must take is updating their insurance policies. Besides health, once you’re married, you should review your auto, homeowners, and life insurance policies to ensure it’s taking into consideration your new marriage and providing adequate coverage. For instance…

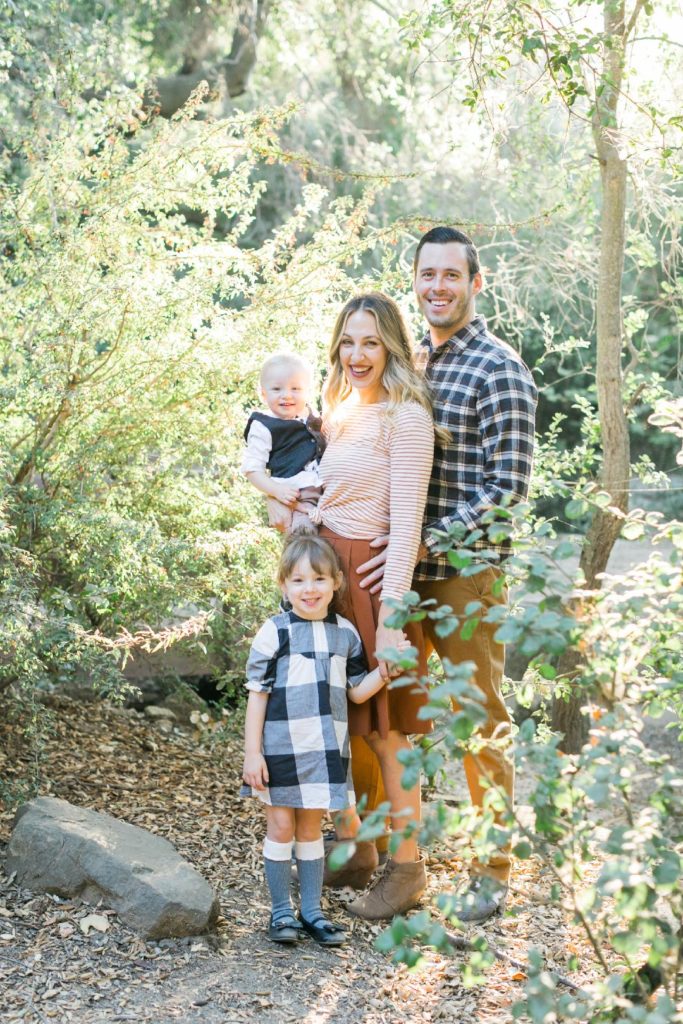

It can be both exciting and stressful for newlyweds to merge their lives together. Once married, you tend to move in together, share finances, share debts, change last names, and transition from single life to a partnership. However, one of the most important actions newlyweds must take is updating their insurance policies. Besides health, once you’re married, you should review your auto, homeowners, and life insurance policies to ensure it’s taking into consideration your new marriage and providing adequate coverage. For instance… Meet Alex, owner and partner of The Napolin Law Firm. Alex has quickly positioned himself as the leading personal injury attorney in all of Southern California.

Meet Alex, owner and partner of The Napolin Law Firm. Alex has quickly positioned himself as the leading personal injury attorney in all of Southern California. Meet his wife, Jenna, who dedicated three years to the Downtown Women’s Center addressing poverty and homelessness in Skid Row; after which she took on a more selfless role as mother to their two beautiful children.

Meet his wife, Jenna, who dedicated three years to the Downtown Women’s Center addressing poverty and homelessness in Skid Row; after which she took on a more selfless role as mother to their two beautiful children.

Thank you to The Napolin Family for their trust and business. We value them as clients and great people!

Thank you to The Napolin Family for their trust and business. We value them as clients and great people!

Recent Comments