Southern California Earthquakes and Earthquake Insurance – Have you felt all the earthquakes recently? Whether you live in Orange County, Los Angeles County, or the Inland Empire, in the past recent weeks, a swarm of earthquakes have made their presence. We know earthquakes aren’t something new in Southern California; however, the swarm and the unexpected turn it has recently taken is new and something to consider.

Just to place it in perspective, on June 5, 2019, a 4.3 earthquake centered nine miles south of San Clemente hit at 3:47 a.m. Later that day, at 7:32 a.m, another 4.3 magnitude quake hit almost the exact same spot! Then, we have around Fontana in the Inland Empire. Since May 25, 2019 (that’s only a couple of weeks), there have been MORE THAN 700 EARTHQUAKES!

We have clients calling in concerned because they’re feeling earthquake after earthquake, day after day! What is going on? Although Caltech seismologist, Egill Hauksson, said the chance that the series of tremors will turn into a large and destructive quake isn’t particularly high, what is unusual is that this swarm of quakes were initially moving northward…but then yesterday they turned around and started going back South, towards the middle of the activity and the 60 Freeway.

“This is somewhat of an unexpected evolution,” said Hauksson. In addition, the earthquake activity is fading much slower than expected, leading to Hauksson’s statement: “That would suggest it’s going to continue for – I don’t know – at least several weeks.” Hauksson also said that GIVEN ALL THE SEISMIC ACTIVITY, residents should be ready and make sure to store “plenty of water [and that] there’s nothing that can fall on them.”

Expert Recommendations for Dealing With Southern California Earthquakes

- Removing all heavy objects from around beds and sitting areas.

- Strapping bookcases and dressers to walls.

- Anchoring flat-screen TVs and pictures frames to walls.

- Note, the last known fatality from an earthquake in California was due to an unstrapped television hitting someone in the head. So make sure all heavy objects are strapped.

- Preparing an emergency bag.

- MAKING SURE YOUR HOME HAS ADEQUATE EARTHQUAKE INSURANCE COVERAGE.

In terms of Earthquake insurance, did you know that standard home insurance doesn’t pay for any damages from earthquakes? Earthquake insurance can be offered as an add-on or a separate policy, but whether you have it or whether you have enough coverage can be mystifying if you haven’t discussed it with your insurance broker.

Given all the seismic activity, we can’t stress enough the importance of having your current policy reviewed by us to ensure you have adequate earthquake coverage.

Earthquake insurance can pay for repairs to your home and attached structures (i.e. garages), your personal belongings (i.e. furniture and clothes), and additional living expenses (i.e. hotel bills if you can’t live in your home due to an earthquake) if an earthquake strikes. This is huge and it’s not worth the expensive risk of going unprotected!

In terms of how much coverage you will need, contact us today and we can see what’s best for you, your family, and your home!

Teen Driver’s Car Insurance, Glendora – One day we’re teaching our kids to sit properly in their car seat, hold our hands and look both ways as they cross the road, and carefully drive their power wheels without running into things. But the next??? The next, we’re teaching them how to adjust the car’s mirrors and seat, slowly release their foot off the brake and press the gas, maintain a safety cushion with their surroundings, safely change lanes, check for blind spots, and make a safe three-point turn. Embarking on the journey of acquiring a teenage driver can be an emotional roller coaster.

Teen Driver’s Car Insurance, Glendora – One day we’re teaching our kids to sit properly in their car seat, hold our hands and look both ways as they cross the road, and carefully drive their power wheels without running into things. But the next??? The next, we’re teaching them how to adjust the car’s mirrors and seat, slowly release their foot off the brake and press the gas, maintain a safety cushion with their surroundings, safely change lanes, check for blind spots, and make a safe three-point turn. Embarking on the journey of acquiring a teenage driver can be an emotional roller coaster.

1) OAK Insurance Solutions is a California company in itself. We know fire has been and unfortunately will continue to be part of California. That said, we also know how hard homeowners work to purchase and keep their home. Accordingly, we firmly stand on doing everything in our power to make sure our clients can obtain and will keep their insurance. We’ve been hearing a lot of stories regarding homeowners opting to go uninsured because they can’t find affordable fire insurance. Do not take the risk! To save you time and money, we can shop and compare rates on your behalf, and set you up with affordable, quality, insurance coverage.

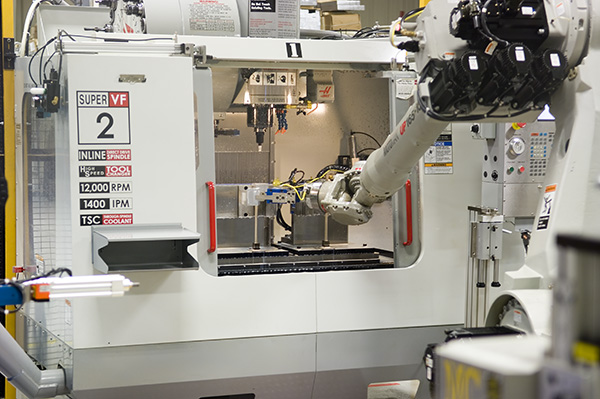

1) OAK Insurance Solutions is a California company in itself. We know fire has been and unfortunately will continue to be part of California. That said, we also know how hard homeowners work to purchase and keep their home. Accordingly, we firmly stand on doing everything in our power to make sure our clients can obtain and will keep their insurance. We’ve been hearing a lot of stories regarding homeowners opting to go uninsured because they can’t find affordable fire insurance. Do not take the risk! To save you time and money, we can shop and compare rates on your behalf, and set you up with affordable, quality, insurance coverage. At OAK Insurance Solutions we’re all about delivering results. We know what most of our clients want, and that is, quality coverage at reduced rates. As the neighborhood’s insurance agency, we aim to please. Accordingly, when we met Swiss House, Inc., a precision job shop manufacturer, we were able to reduce their annual premium by 30% and workers compensation net rates by 15%. Additionally, we increased their insurance limits by 25% to 100% and set them up with cyber and product liability as well. Thank you to Swiss House, Inc. for their trust and business. We value you them as clients and a company!

At OAK Insurance Solutions we’re all about delivering results. We know what most of our clients want, and that is, quality coverage at reduced rates. As the neighborhood’s insurance agency, we aim to please. Accordingly, when we met Swiss House, Inc., a precision job shop manufacturer, we were able to reduce their annual premium by 30% and workers compensation net rates by 15%. Additionally, we increased their insurance limits by 25% to 100% and set them up with cyber and product liability as well. Thank you to Swiss House, Inc. for their trust and business. We value you them as clients and a company!

OAK Insurance Solutions would like to take a moment and recognize our newest client, Dr. Abaro, DDS Inc.! Looking to increase coverage, while reducing his rates, Dr. Abaro contacted our agency. After a comprehensive analysis of his needs and goals, we were able to increase his business owner’s policy’s insurance limits anywhere from 15% to 100%. We set him up with an all-encompassing blanket P&C coverage, cyber liability blanket coverage, employee benefits liability blanket coverage, accounting/billing implementation per location, as well as reduced his workers compensation net rates by 5% and saved him 5% on insurance at each of his locations. Thank you to Dr. Abaro, DDS, Inc. and his staff for their trust and business. We value you them as clients and as an incredible corporation!

OAK Insurance Solutions would like to take a moment and recognize our newest client, Dr. Abaro, DDS Inc.! Looking to increase coverage, while reducing his rates, Dr. Abaro contacted our agency. After a comprehensive analysis of his needs and goals, we were able to increase his business owner’s policy’s insurance limits anywhere from 15% to 100%. We set him up with an all-encompassing blanket P&C coverage, cyber liability blanket coverage, employee benefits liability blanket coverage, accounting/billing implementation per location, as well as reduced his workers compensation net rates by 5% and saved him 5% on insurance at each of his locations. Thank you to Dr. Abaro, DDS, Inc. and his staff for their trust and business. We value you them as clients and as an incredible corporation!

Recent Comments